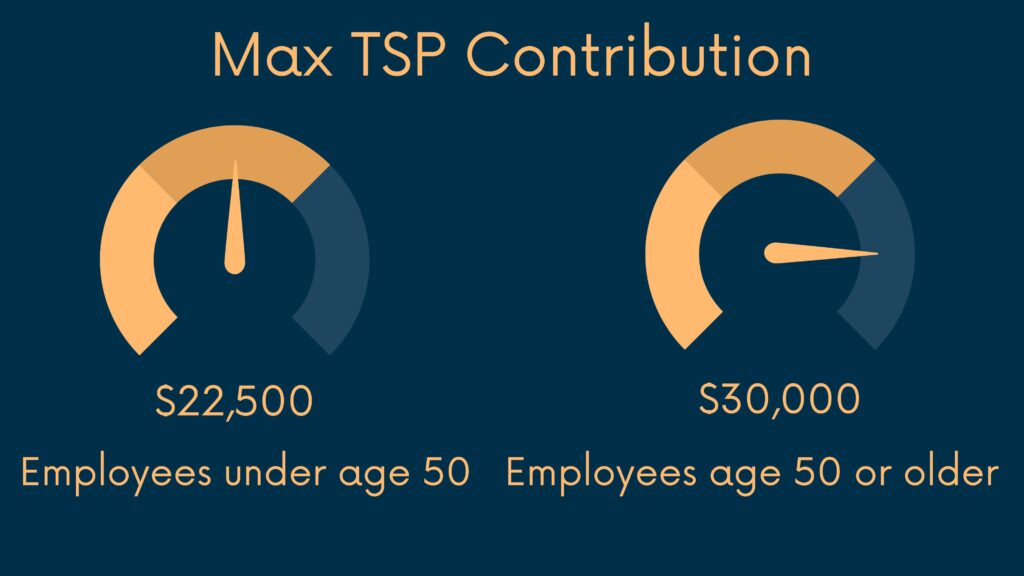

Tsp Catch Up 2025. Hosted by nelly furtado, global. The elective deferral limits for 2025 increased by a modest $500 from 2025, from $22,500 to $23,000.

The annual contribution limit for the thrift savings plan (tsp) will increase by 2.2% in 2025 according to mercer, a benefits consulting firm that is. Best budget solar eclipse glasses.

20192024 Form TSP1C Fill Online, Printable, Fillable, Blank pdfFiller, The ira catch‑up contribution limit for individuals aged 50 and. To contribute the 2025 maximum.

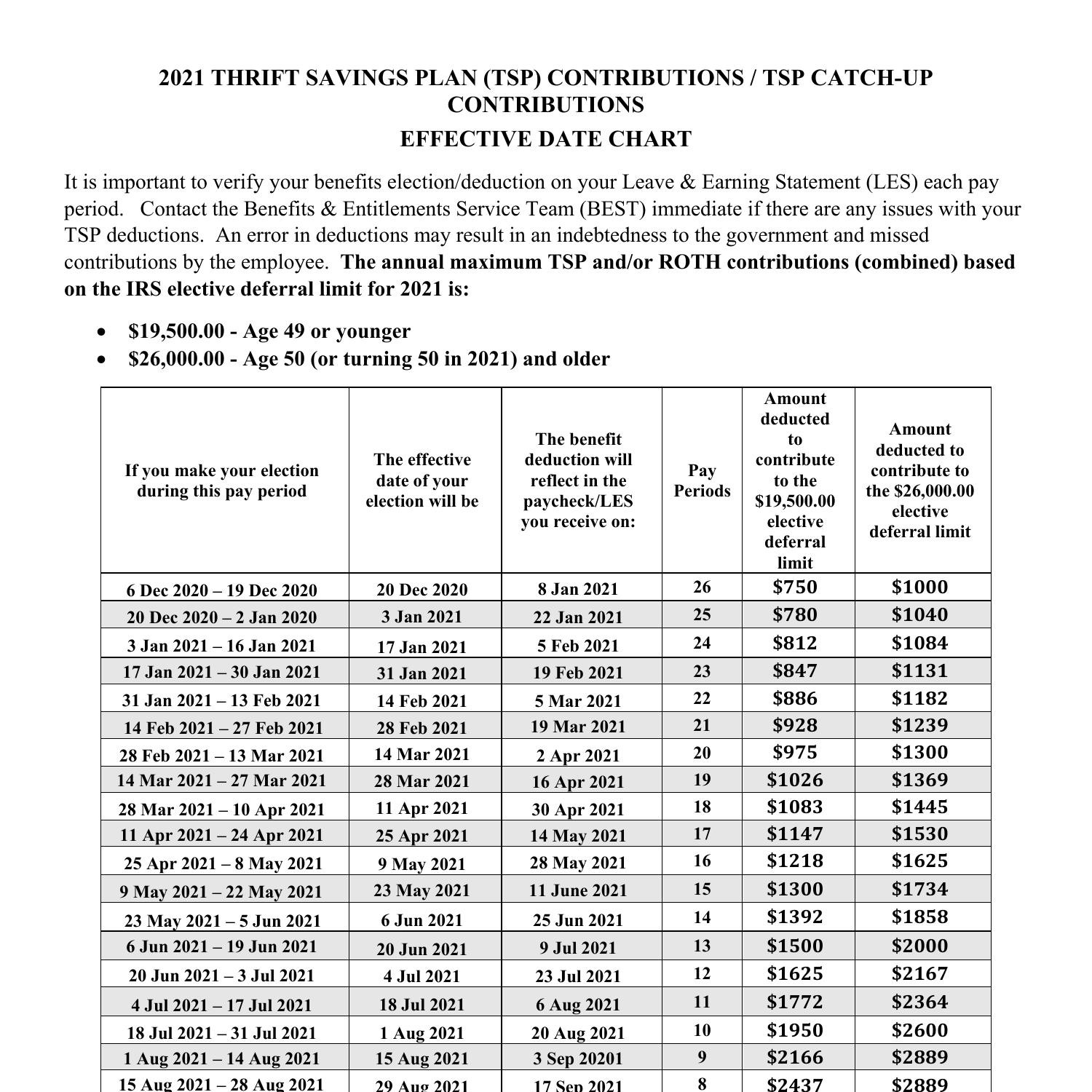

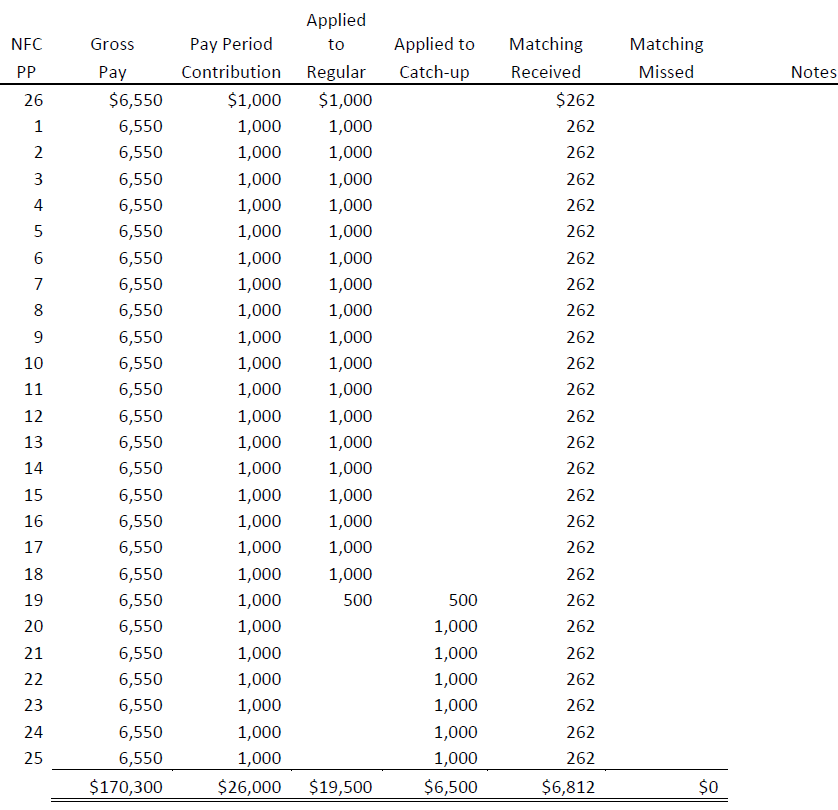

2025 TSP Contributions and TSP CatchUp Contributions Effective Date, The g fund went from $240.1 billion in december 2025 to $234.3 billion in february 2025—a decline of $5.8 billion when total tsp assets went from. This amount is in addition to the regular tsp limit of $23,000.

PPT Employee Benefits and Retirements PowerPoint Presentation, free, This amount is in addition to the regular tsp limit of $23,000. Below are the 2025 irs limits and additional information to keep you informed.

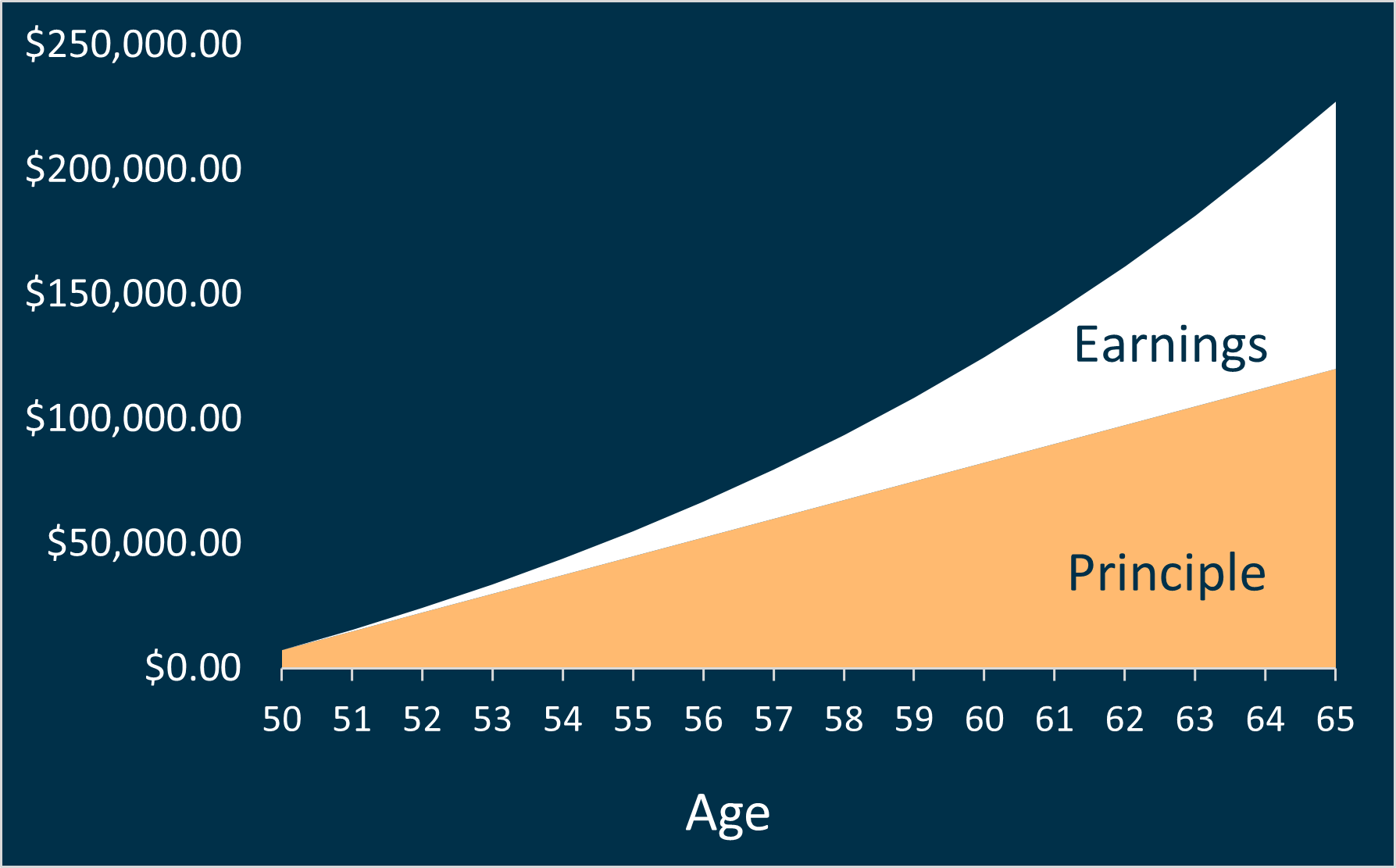

Are TSP catchup contributions worth it?, This amount is in addition to the regular tsp limit of $23,000. To contribute the 2025 maximum.

2019 TSP CatchUp Contributions and Effective Date Chart Working, Annual limit on elective deferrals pdf (part 1: To contribute the 2025 maximum.

Are TSP catchup contributions worth it?, Most tsp participants will receive a. The ira catch‑up contribution limit for individuals aged 50 and.

Expanded Roth TSP CatchUp Contribution Opportunities, Best budget solar eclipse glasses. Get ready for the junos in halifax this weekend!

Blog Fed Savvy, Best budget solar eclipse glasses. Irs sets the limits each year on how much can be contributed to the tsp.

PPT Federal Retirements PowerPoint Presentation, free download ID, The elective deferral limits for 2025 increased by a modest $500 from 2025, from $22,500 to $23,000. Can i contribute 100% of my salary.

2025 TSP CatchUp Contributions and Effective Date Chart.pdf DocDroid, Limits* have changed for 2025: The 2025 limit on annual contributions to an ira increased to $7,000, up from $6,500.

For the year 2025, the new maximum amount for funding your tsp (or any 401 (k), 403b, 457, etc.) is now $23,000, up from $22,500, for those under age 50.